Many of the challenges the pandemic caused for commercial real estate have continued into 2021, causing investors to look for safe havens after the tumult of the past 12 months. A key sector showing great potential is medical real estate, especially medical office buildings and retail repurposed as urgent care facilities. The pandemic has stabilized the interest rates for medical commercial spaces, with anticipation that they will be significantly lower throughout 2021.

There’s no question demographics are playing a role in the growth in demand for healthcare real estate. The need for preventive and personalized care among millennials and seniors was already reshaping healthcare real estate before the pandemic. America’s aging demographics appear to directly correlate with increased real estate demand for health services.

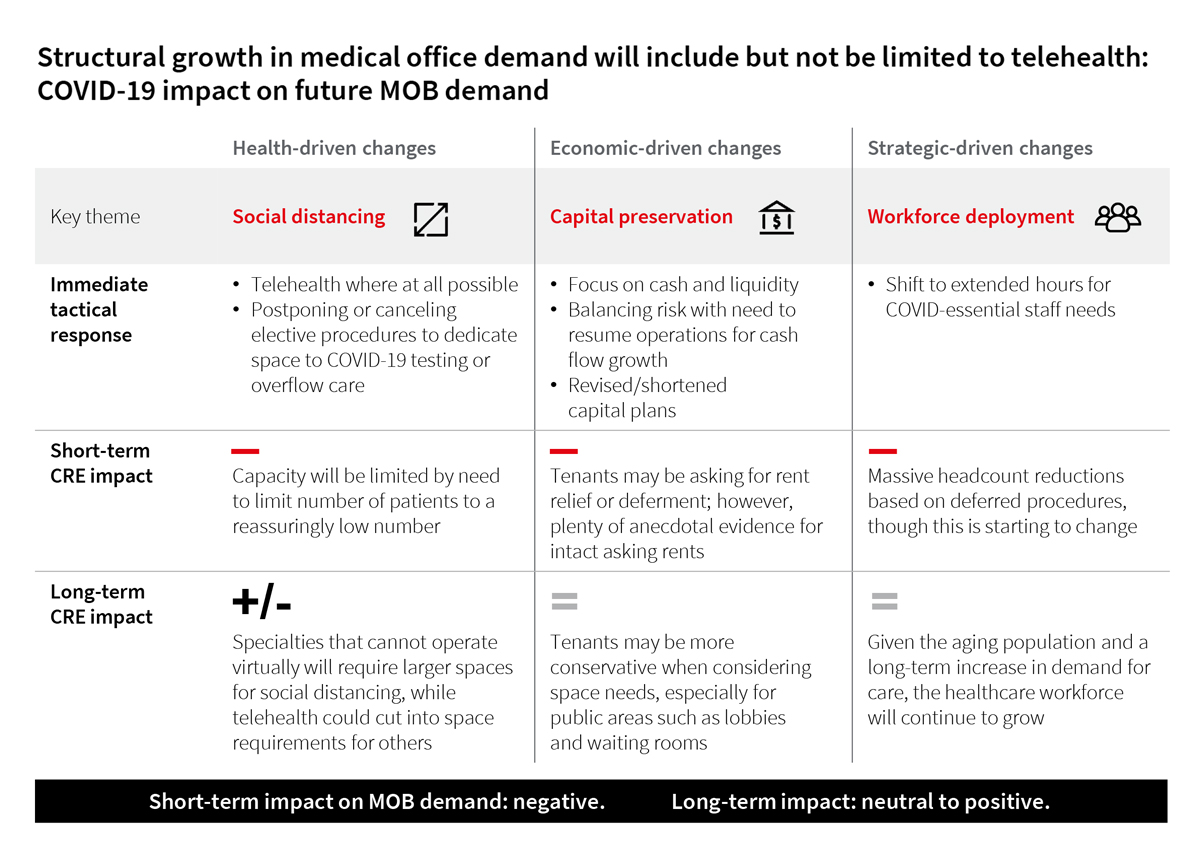

Telehealth use has risen around 50% in primary care settings since the beginning of the pandemic and is projected to remain high, given the sudden rise in telemedicine and telemedicine software platforms, according to the Department of Health & Human Services. However, the expectation is that it will benefit traditional medical real estate, allowing it to evolve quickly to meet patient needs and costs. This shift will begin to show the effects of a new telemedicine/patient demand and may lead to repurposing medical real estate spaces from private practitioner use to clinics and other hospital-branded facilities rather than leaving them vacant, according to the Department of Health & Human Services.

Healthcare demand is growing across the medical industry space, according to FH Healthcare Indicators and FH Medical Price Index data quoted in a recent FAIR Health white paper. It listed utilization of emergency rooms by 33%, ambulatory surgery centers by 30%, retail clinics by 39% and urgent care centers by 47%.

Urgent Needs

In fact, while urgent care centers are a relatively new entrant to medical industry space, their number had risen by 6% between 2018 and June of 2019, from 8,774 U.S. centers to 9,272, according to Forbes, with a shift of ownership from physician and medical groups to large health systems. Many urgent care practices are situated in retail spaces, colloquially termed “medtail,” and present a good alternative to fill vacant space within a pharmacy or elsewhere within a retail shopping center.

Urgent cares represent an opportunity for retail landlords who have seen tenants depart or close their doors in 2020. Cap rates for urgent cares fell 12 basis points to 7.13% year-over-year in the third quarter.

Health clinics are also well positioned to backfill space for a variety of tenants downsizing or shifting format. Health clinics are convenient and easier to find than a hospital and provide a use-replacement and cost-effective alternative to a hospital or doctor’s office.

A potential solution being considered is sale-leasebacks of existing vacant space. A sale-leaseback enables the original owner of a commercial space to sell their asset to a buyer, who will let them lease their property until they fully pay the price that they have agreed on.

Adjustments Needed

For medical facilities of any kind, the high rise of patients in 2020 due to COVID-19 evidenced a lack of capacity or in some cases a need to close for long periods of time. Owners of healthcare real estate are looking at creative, profitable solutions to address these shortcomings.

In 2021, healthcare real estate will have to adjust their building spaces. For example, they might want to reduce the waiting area and make the treatment area wider. They will also need to allow for greater social distancing, requiring structural and spatial improvements so consumers and staff feel safe.

“The healthcare sector continues to play a dominant role in the U.S. economy and has displayed year-on-year growth for many decades,” Martin Freeman, CEO of OrbVest, a global real estate company that invests in U.S. income-producing medical commercial real estate, told Nuwire Investor.

Add Comment