With sales of recreational vehicles and boats hitting new highs, demand is growing for RV/boat exclusive storage facilities. Americans are increasingly taking time off in natural settings such as parks and lakes, in part as a way of relaxing away from crowds during the pandemic.

That prompted sales and usage of RVs and boats to hit new highs in 2021. The growth in the segment led Yardi Matrix to create a database of RV/boat exclusive storage facilities as a supplement to its database of self storage properties, which is the largest in the U.S.

Yardi’s database encompasses 786 completed RV/boat exclusive storage properties in the U.S. with 6,850 acres of space and another 35 facilities that are in the development pipeline. Metros with the largest amount of RV/boat storage include Denver, San Francisco, Dallas, Houston and Phoenix. These metros have large populations and are within proximity to parks and campgrounds, RV rental facilities, waterways and large populations.

Yardi’s database finds that Denver leads metros in RV/boat exclusive storage in acreage with 596.8, followed by San Francisco (420.4), Dallas (345.7), Houston (302.9) and Phoenix (299.3). Denver also leads with 47 properties, followed by Houston (45), San Francisco (39), the Inland Empire (36) and Los Angeles (35).

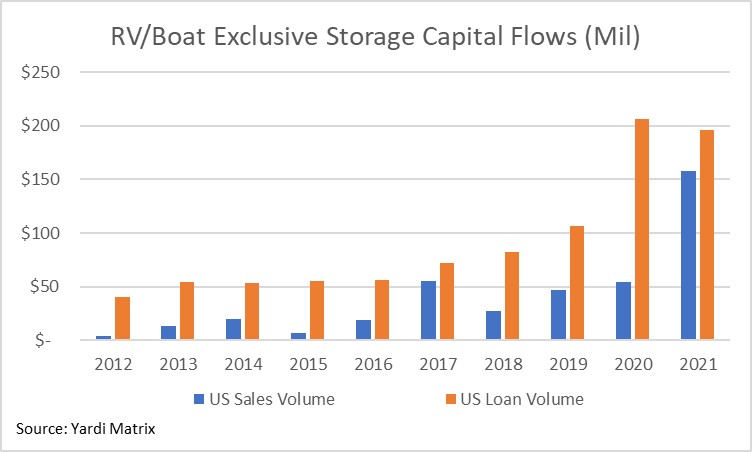

Although it remains relatively small compared to other niche segments of commercial real estate, the industry registered record-high capital flow in 2021, a sign that investors are increasingly taking notice. Some $157.7 million of RV/boat exclusive facilities were sold in 2021, almost triple the previous annual high.

RV/Boat Usage on the Upswing

Data from industry trade groups demonstrates the growth in ownership and usage of RVs and boats. RV wholesale shipments reached a record 600,240 in 2021, up 39.5% over the 430,412 units shipped in 2020 and surpassing the prior record set in 2017 of 504,599 shipments, according to the Recreational Vehicle Industry Association.

Likewise, the acquisition and use of boats is growing. According to the National Marine Manufacturers Association, new powerboat retail unit sales are expected to surpass 300,000 units for the second consecutive year in 2021. Sales in 2021 are expected to be down slightly from 2020, the previous record high, but will be 7% above the five-year average. The NMMA projects 2022 sales to surpass 2021 totals by as much as 3%.

Americans have long had a love affair with RVs and boats, and the RV/boat exclusive storage segment has been around for decades. But like many other developments involving work and migration, the pandemic has created behavioral changes and exacerbated some existing trends.

Foremost among the reasons is the desire to travel and have recreational experiences without crowds. Over the last two years, many Americans avoided airplanes and other forms of public transportation in favor of ground travel.

Another driver of the growth in RV and boat sales is the healthy balance sheets of households as people stopped spending while sheltered in place and collected stimulus checks from the federal government.

Younger Americans also got into the act. The pandemic helped stoke a growing appreciation for recreation and travel to rural settings. What’s more, some found that they could work from remote locations, which means they can live in RVs and work, not just use them for travel.

Yet another development advantageous to RV/boat exclusive storage demand is the growth in Airbnb-type online apps, which enable RV owners to rent vehicles that are parked in storage facilities. The RVIA notes that median annual usage of RVs is 25 days a year, which means that many vehicles are in storage the vast majority of the year. Renting stored vehicles can generate significant income for owners.

Growing Niche

Recreational vehicles and boats are a durable part of the American experience, and economic and social trends indicate that is likely to intensify in coming years. As sales of RVs and boats increase, the demand to store the vehicles is likely to grow. Traditional self storage facilities have limited space and amenities to store RVs and boats, which means that demand for RV/boat exclusive facilities will likely grow as RV and boat sales rise.

Growth of RV/boat exclusive facilities might be constrained by the cost of land, the amount of acreage needed to house vehicles and the fact that the facilities are geared toward specific objects as opposed to general usage. At the same time, though, the growing demand from RV and boat sales combined with the limited amount of supply means the segment’s fundamentals should remain healthy, even in volatile economic times.

Read the full Matrix Bulletin-RVBoat Storage-March 2022

We are past the record highs of RV and boat sales. However, demand for RV and boat storage should remain somewhat stable as existing owners still need a place to store their toys.

It will be interesting to see the new data for 2023 when it comes out.